Benefits to Discovery Group Members

Components of an Option Agreement

An option agreement is a method for obtaining an exploration project which outlines the legal provisions governing the potential acquisition of mineral rights. It specifies the terms and conditions that allow one party, known as the optionee, to potentially secure mineral rights for an exploration property from another party, known as the optionor. In this case, it's important to note that the optionor has already staked or obtained the mineral rights.

Components of a typical option agreement:

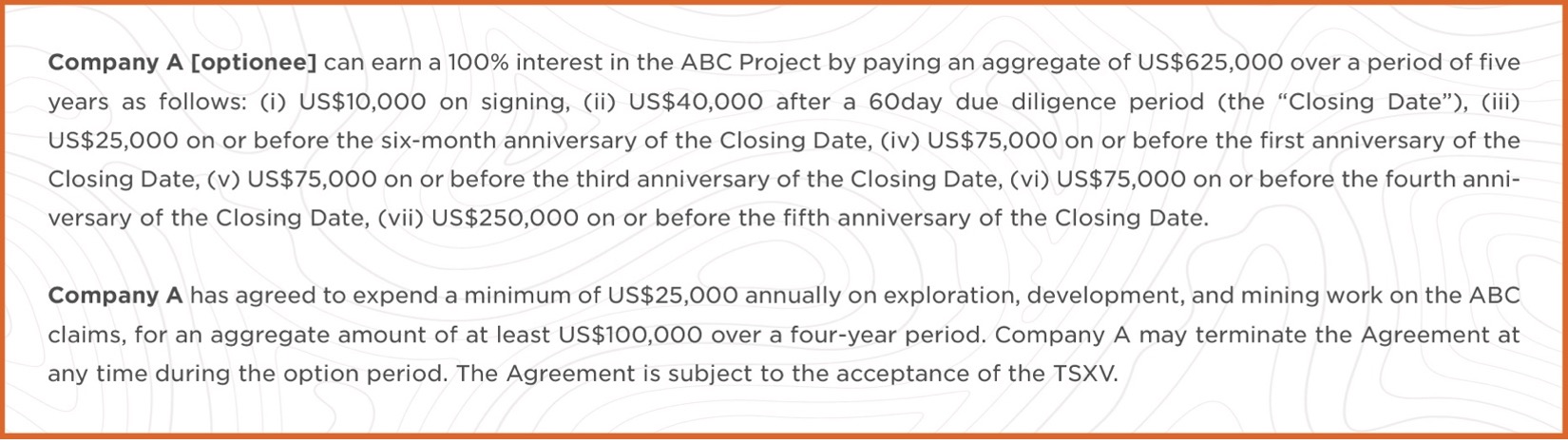

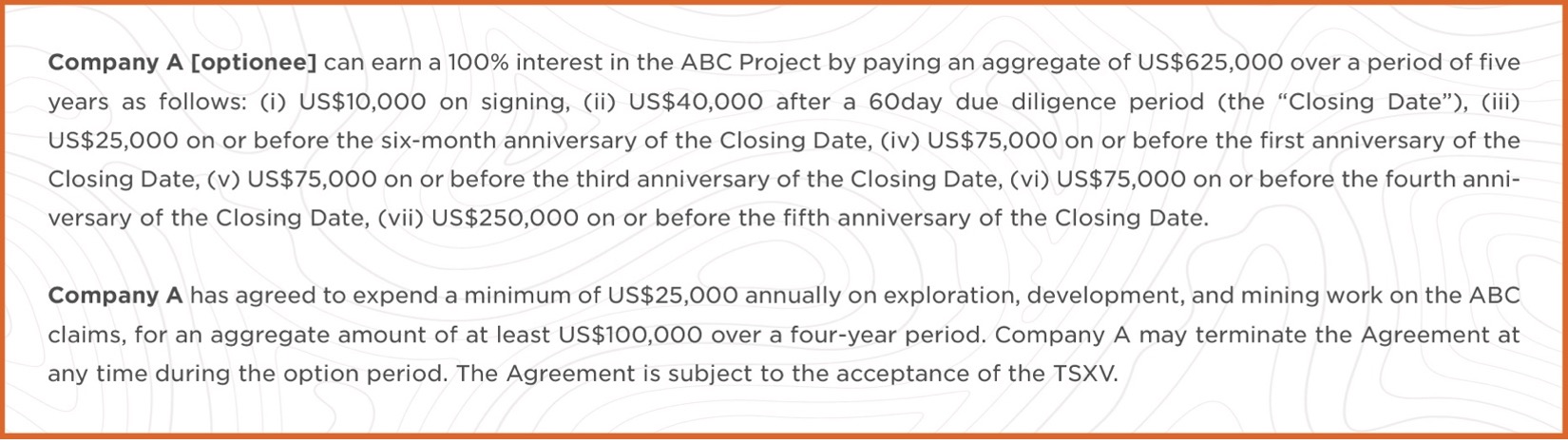

- Cash Payments

In the majority of option agreements, financial transactions occur through periodic cash payments. These payments involve the optionee remitting a predetermined sum of money to the optionor at yearly intervals. Notably, these cash payments tend to increase with each year of the option's duration.

- Stock Issuance

In addition to, or occasionally in lieu of cash payments, the optionee may opt to allocate a specific quantity of company shares to the optionor at yearly intervals. The allotment of shares usually increases with each year of the option's tenure.

- Work Commitment

Most agreements involve annual work commitments, which demand the optionee to fulfill a specified dollar value of work to uphold the option. Typically, as more work is undertaken on a project, its value tends to increase, driven by an enhanced understanding of its mineral potential.

- Percentage of Property Acquired

Option agreements must clearly define the extent of property ownership that the optionee will attain once the agreement is fulfilled. These agreements can range from full, 100% ownership to partial ownership. Furthermore, the acquisition percentage may be structured in stages, allowing for a progressive increase in property ownership based on factors like completed work, cash payments, or stock issuance.

- Time Length of the Option

Typically, option agreements are structured in yearly intervals, during which the optionee is required to make predetermined cash and/or stock payments, as well as fulfill specified work requirements to sustain the option. The duration of most agreements typically falls within a range of two to five years.

- Termination of the Option

An option agreement will remain in good standing as long as all of the terms in it are upheld. In the event that the optionee fails to fulfill any of these terms during the agreement's duration, the option agreement will be terminated, leading to the project reverting to the optionor.

Example of the terms of an Option Agreement, as commonly seen in exploration companies’ news releases:

Learn More