Great Bear Drills 81.22 g/t Gold Over 10.50 m at Bedrock Surface at LP Fault

August 4, 2020 – Vancouver, British Columbia, Canada – Great Bear Resources Ltd. (the "Company" or "Great Bear", TSX-V: GBR; OTCQX: GTBAF) today reported results from its ongoing fully funded $21 million exploration program at its 100% owned flagship Dixie Project in the Red Lake district of Ontario.

Highlights Include:

- Two new drill sections were completed within a previously undrilled 140 metre long segment of the LP Fault

- These sections contained significant thicknesses of very shallow high-grade gold mineralization starting at the bedrock surface including 81.22 g/t gold over 10.50 metres

- Repeated intersection of high-grade gold mineralization during 2020 LP Fault drilling has led to a new geological model being prepared by the Company. Initial results are included in this release.

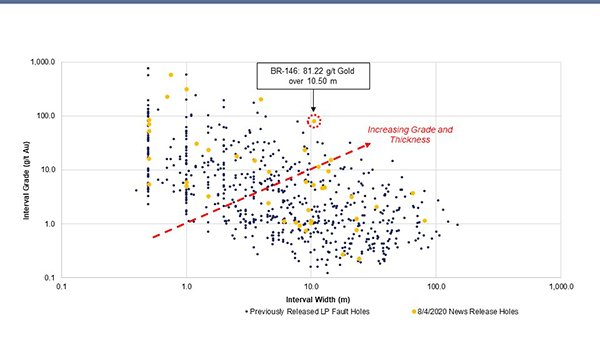

Figure 1: Newly reported LP Fault drill intervals plotted versus all previously reported LP Fault drill intervals. Data is from 126 reported drill holes.

Chris Taylor, President and CEO of Great Bear said, “New results from a 140 metre long previously undrilled segment within the LP Fault include 81.22 g/t gold over 10.50 metres at bedrock surface, with excellent continuity of mineralization once again observed across adjacent drill sections and to depth on the same drill section. Over the past months we have regularly intersected predictable high-grade gold intervals at the LP Fault within the broad bulk-tonnage style gold system. This positive development is underscored by both styles of mineralization extending from bedrock surface to the limits of current drilling at depth. We are currently building an updated geological model to account for the majority of this high-grade mineralization, and provide early descriptions of this work in this release.”

The Company has completed 126 of approximately 300 planned drill holes into the LP Fault target, as part of its 5 kilometre long by 500 metre deep grid drill program.

Current Results Highlights

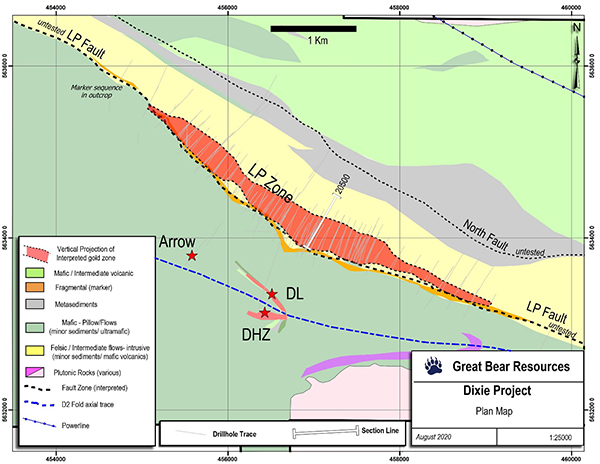

Two drill sections were completed within a previously undrilled 140 metre long gap along the LP Fault; sections 20500 and 20450. High-grade gold and wider intervals of moderate gold grades were seen in both sections. The location of drill section 20500 is provided in Figure 2. New assay results are provided in Table 1 and Figure 3, and include:

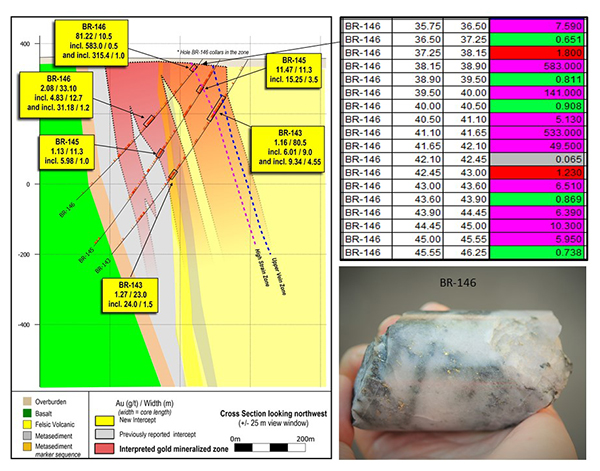

- Drill hole BR-146 on drill section 20500 intersected 209.42 g/t gold over 3.95 metres, within a broader interval of 81.22 g/t gold over 10.50 metres. Mineralization began at the bedrock surface, at a down-hole depth of 35.75 metres.

- A deeper interval in the same drill hole returned 2.08 g/t gold over 33.10 metres at a downhole depth of 210.90 metres.

- Continuity of gold mineralization was demonstrated on the same drill section with drill holes BR-143 and BR-145 intersecting gold mineralization 120 and 160 metres vertically below BR-146, respectively.

- Highlights from BR-143 include 9.34 g/t gold over 4.55 metres, within a broader interval of 3.24 g/t gold over 21.00 metres, and 70.60 g/t gold over 0.50 metres, within a broader interval of 1.50 g/t gold over 24.00 metres.

- Highlights from BR-145 include 15.25 g/t gold over 3.50 metres, within a broader interval of 11.47 g/t gold over 11.30 metres.

- Continuity of gold mineralization was also demonstrated on adjacent drill section 20450, located 50 metres to the southeast of BR-146.

- Drill hole BR-144 intersected 23.46 g/t gold over 8.80 metres, including a higher-grade sub-interval of 231.00 g/t gold over 0.50 metres. The total mineralized interval was 3.73 g/t gold over 65.00 metres.

Additional drill results were returned from the same mineralized zone on drill section 20900, located 400 metres to the northwest of drill hole BR-146. Highlights include:

- Drill hole BR-160 returned 18.31 g/t gold over 2.50 metres, within a broader interval of 4.62 g/t gold over 12.15 metres.

Figure 2: Location of drill sections provided as section figures in this release.

Figure 3: Drill section 20500 showing highlighted results from BR-143, BR-145 and BR-146. All individual assay intervals are provided from the reported shallow high-grade interval in BR-146, together with an image of visible gold mineralization from this drill hole. Images of gold mineralization are from selected intervals and are not representative of all of the gold mineralization on the property.

Table 1: Current drill results. Drill sections are arranged from southeast (top of Table) to northwest (bottom of Table).

| Drill Hole | From (m) | To (m) | Width* (m) | Gold (g/t) | Section | |

| BR-150 | 164.25 | 182.00 | 17.75 | 0.28 | 20300 | |

| and | 221.00 | 227.00 | 6.00 | 1.12 | ||

| and | 402.00 | 425.00 | 23.00 | 0.78 | ||

| including | 403.30 | 404.80 | 1.50 | 3.26 | ||

| and | 413.50 | 414.00 | 0.50 | 5.45 | ||

| BR-144 | 89.00 | 154.00 | 65.00 | 3.73 | 20450 | |

| including | 130.00 | 144.25 | 14.25 | 15.31 | ||

| and including | 132.50 | 141.30 | 8.80 | 23.46 | ||

| and including | 140.60 | 141.30 | 0.70 | 231.00 | ||

| and | 373.00 | 380.50 | 7.50 | 1.08 | ||

| and | 507.00 | 516.85 | 9.85 | 1.04 | ||

| BR-143 | 116.50 | 197.00 | 80.50 | 1.16 | 20500 | |

| including | 149.50 | 150.50 | 1.00 | 5.09 | ||

| and including | 173.00 | 194.00 | 21.00 | 3.24 | ||

| and including | 182.00 | 191.00 | 9.00 | 6.01 | ||

| including | 186.45 | 191.00 | 4.55 | 9.34 | ||

| and | 204.30 | 204.80 | 0.50 | 16.50 | ||

| and | 355.00 | 379.00 | 24.00 | 0.23 | ||

| and | 384.00 | 407.00 | 23.00 | 1.27 | ||

| and | 425.05 | 426.55 | 1.50 | 24.00 | ||

| including | 425.55 | 426.05 | 0.50 | 70.60 | ||

| BR-146 | 35.75 | 46.25 | 10.50 | 81.22 | 20500 | |

| including | 38.15 | 42.10 | 3.95 | 209.42 | ||

| and including | 38.15 | 38.90 | 0.75 | 583.00 | ||

| and including | 41.10 | 42.10 | 1.00 | 315.43 | ||

| and | 210.90 | 244.00 | 33.10 | 2.08 | ||

| including | 227.30 | 240.00 | 12.70 | 4.83 | ||

| and including | 227.30 | 228.50 | 1.20 | 31.18 | ||

| and | 331.50 | 340.95 | 9.45 | 1.81 | ||

| BR-145 | 93.75 | 107.40 | 13.65 | 9.54 | 20500 | |

| including | 95.60 | 106.90 | 11.30 | 11.47 | ||

| and including | 95.60 | 96.10 | 0.50 | 85.70 | ||

| and including | 99.85 | 103.35 | 3.50 | 15.25 | ||

| and including | 102.85 | 103.35 | 0.50 | 52.80 | ||

| and | 182.00 | 192.00 | 10.00 | 1.13 | ||

| and | 352.80 | 353.80 | 1.00 | 5.98 | ||

| and | 373.00 | 377.50 | 4.50 | 2.43 | ||

| and | 448.00 | 456.00 | 8.00 | 0.94 | ||

| BR-160 | 19.25 | 31.40 | 12.15 | 4.62 | 20900 | |

| including | 21.00 | 31.40 | 10.40 | 5.34 | ||

| and including | 21.00 | 23.50 | 2.50 | 18.31 | ||

| and | 142.50 | 151.50 | 9.00 | 0.76 |

*Widths are drill indicated core length, as insufficient drilling has been undertaken to determine true widths at this time. Average grades are calculated with un-capped gold assays, as insufficient drilling has been completed to determine capping levels for higher grade gold intercepts. Average widths are calculated using a 0.10 g/t gold cut-off grade with up to 3 m of internal dilution of zero grade.

Update on Geological Modeling

Great Bear continues to collect and interpret data to refine the geological model for the entire Dixie property. To date, the company has collected > 164,000 drill core samples and > 100,000 downhole data observations including alteration, mineralization and > 36,000 oriented structural core measurements. These data points together with ongoing cross section and 3D geological modelling continue to guide exploration drilling on the property.

While the Hinge and Dixie Limb zones are being modelled as discrete vein / replacement zones within dominantly mafic volcanic rocks, the LP Fault system consists of a broad and laterally continuous zone of disseminated gold mineralization which contains several discrete foliation parallel zones of higher grade gold mineralization with generally steeply-dipping planar geometries, hosted within both felsic-intermediate volcanic (“FV”) rocks and meta-sedimentary (“MS”) rocks. The “sheet-like” geometry of these zones adds to their predictability across drill sections and to depth and continues to facilitate their targeting during ongoing exploration.

The broad zone of gold mineralization at the LP Fault is associated with specific rock types, geological contacts and alteration assemblages. These rock types are recorded during core-logging and contact relationships are later refined in the 3D model once lithogeochemical data are available.

To date, two discrete high grade corridors extending to the depths of current drilling, have been identified through interpretation and re-logging of drill core from within the LP Fault:

- “Upper Vein Zone” - A discrete zone containing up to 60% deformed and transposed quartz veins. Gold occurs in both veins and wall rock and is interpreted through multiple drill holes to extend for more than 700 metres of strike, which remains open to extension in all directions.

- “High Strain Zone” – A discrete zone of increased foliation parallel strain where gold has been observed along foliation planes (without quartz veining). In addition to the high degree of strain, the zone is also marked by an increase in silicification and local sulphide mineralization and is interpreted through multiple drill holes to extend along a strike length of at least 1.1 kilometres, which remains open to extension in all directions.

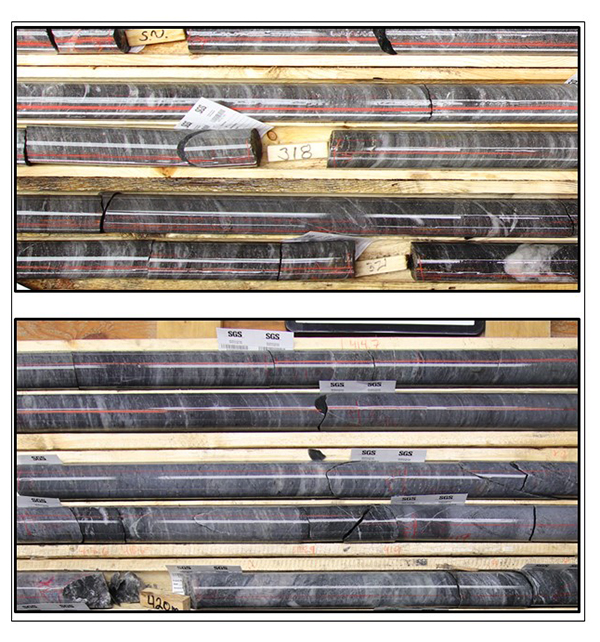

Additional high-grade zones within the LP Fault are also being interpreted and tested with on-going drilling. Representative core photos of the Upper Vein Zone and High Strain Zone are included in Figure_4.

The Company will release a comprehensive geological and mineralization model update when current data collection and modeling work on these and other high-grade gold zones is complete.

Figure 4: Newly defined high-grade gold domains within the LP Fault.

Top: Upper Vein Zone. Bottom: High Strain Zone. Note the numerous deformed and transposed gold-bearing veins in the top image, and the relative lack of veining in the bottom image. Both intervals contain sheet-like, planar high-grade gold concentrations that have been successfully targeted within and between multiple drill sections.

Updated drill collar locations, azimuths and dips, together with an updated complete assay table for the LP Fault drilling to-date will be posted to the Company’s web site at www.greatbearresources.ca. Drill collar locations, azimuths and dips for the drill holes included in this release are provided in the table below:

| Hole ID | Easting | Northing | Elevation | Depth | Dip | Azimuth |

| BR-143 | 457081 | 5634208 | 356 | 681 | -60 | 211 |

| BR-144 | 457118 | 5634163 | 354 | 667 | -60 | 212 |

| BR-145 | 457038 | 5634140 | 355 | 643 | -60 | 211 |

| BR-146 | 457015 | 5634096 | 356 | 540 | -54 | 210 |

| BR-150 | 457323 | 5634192 | 356 | 656 | -55 | 209 |

| BR-160 | 456672 | 5634259 | 357 | 591 | -60 | 212 |

About the Dixie Project

The Dixie Project is 100% owned, comprised of 9,140 hectares of contiguous claims that extend over 22 kilometres, and is located approximately 25 kilometres southeast of the town of Red Lake, Ontario. The project is accessible year-round via a 15 minute drive on a paved highway which runs the length of the northern claim boundary and a network of well-maintained logging roads.

The Dixie Project hosts two principle styles of gold mineralization:

- High-grade gold in quartz veins and silica-sulphide replacement zones (Dixie Limb, Hinge and Arrow zones). Hosted by mafic volcanic rocks and localized near regional-scale D2 fold axes. These mineralization styles are also typical of the significant mined deposits of the Red Lake district.

- High-grade disseminated gold with broad moderate to lower grade envelopes (LP Fault). The LP Fault is a significant gold-hosting structure which has been seismically imaged to extend to 14 kilometres depth (Zeng and Calvert, 2006), and has been interpreted by Great Bear to have up to 18 kilometres of strike length on the Dixie property. High-grade gold mineralization is controlled by structural and geological contacts, and moderate to lower-grade disseminated gold surrounds and flanks the high-grade intervals. The dominant gold-hosting stratigraphy consists of felsic sediments and volcanic units.

About Great Bear

Great Bear Resources Ltd. is a well-financed gold exploration company managed by a team with a track record of success in mineral exploration. Great Bear is focused in the prolific Red Lake gold district in northwest Ontario, where the company controls over 300 km2 of highly prospective tenure across 4 projects: the flagship Dixie Project (100% owned), the Pakwash Property (earning a 100% interest), the Dedee Property (earning a 100% interest), and the Sobel Property (earning a 100% interest), all of which are accessible year-round through existing roads.

QA/QC and Core Sampling Protocols

Drill core is logged and sampled in a secure core storage facility located in Red Lake Ontario. Core samples from the program are cut in half, using a diamond cutting saw, and are sent to Activation Laboratories in Ontario, an accredited mineral analysis laboratory, for analysis. All samples are analysed for gold using standard Fire Assay-AA techniques. Samples returning over 10.0 g/t gold are analysed utilizing standard Fire Assay-Gravimetric methods. Pulps from approximately 5% of the gold mineralized samples are submitted for check analysis to a second lab. Selected samples are also chosen for duplicate assay from the coarse reject of the original sample. Selected samples with visible gold are also analyzed with a standard 1 kg metallic screen fire assay. Certified gold reference standards, blanks and field duplicates are routinely inserted into the sample stream, as part of Great Bear’s quality control/quality assurance program (QAQC). No QAQC issues were noted with the results reported herein.

Qualified Person and NI 43-101 Disclosure

Mr. R. Bob Singh, P.Geo, Director and VP Exploration, and Ms. Andrea Diakow P.Geo, Exploration Manager for Great Bear are the Qualified Persons as defined by National Instrument 43-101 responsible for the accuracy of technical information contained in this news release.

ON BEHALF OF THE BOARD

“Chris Taylor”

Chris Taylor, President and CEO

Investor Inquiries:

Mr. Knox Henderson

Tel: 604-646-8354

Direct: 604-551-2360

info@greatbearresources.ca

www.greatbearresources.ca

Cautionary note regarding forward-looking statements

This release contains certain “forward looking statements” and certain “forward-looking information” as defined under applicable Canadian and U.S. securities laws. Forward-looking statements and information can generally be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans” or similar terminology. The forward-looking information contained herein is provided for the purpose of assisting readers in understanding management’s current expectations and plans relating to the future. Readers are cautioned that such information may not be appropriate for other purposes.

Forward-looking information are based on management of the parties’ reasonable assumptions, estimates, expectations, analyses and opinions, which are based on such management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect.

Great Bear undertakes no obligation to update forward-looking information except as required by applicable law. Such forward-looking information represents management's best judgment based on information currently available. No forward-looking statement can be guaranteed and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information.