Ethos establishes new technical advisory team, stakes district scale gold projects in Quebec and Ontario, announces financing

Vancouver, BC – August 5, 2020, Ethos Gold Corp. (“Ethos” or the “Company”) (TSXV:ECC) (OTCQB: ETHOF) is pleased to announce that Rob Carpenter, Ph.D., P.Geo. has joined the Company as Chief Technical Advisor. He will lead a new highly experienced technical advisory team which includes Dr. Robert Brozdowski, Dan MacNeil M.Sc., and Dr. Alan Wainwright. As CEO of Kaminak Gold Corporation, Rob led the Kaminak team from initial listing in 2005 through acquisition and discovery of the multi-million ounce Coffee Gold Project, Yukon. That project was acquired by Goldcorp in 2016 for over $500 million. This team has had a close and successful working relationship over many years leading to a number of significant discoveries and has a long affiliation with Discovery Group of which Ethos is a member. Principals of Discovery Group including John Robins and Jim Paterson are also advisors to Ethos and long-standing shareholders. Ethos is further pleased to announce that Marc L’Heureux, P.Geo., M.A.Sc. has joined the Company as a technical advisor to oversee the Company’s activities in Quebec. Finally Ethos is pleased to announce that Jeff Sundar a long standing member of Discovery Group has joined Ethos as Corporate Development Advisor. Resume’s for the new Ethos advisory team are included in the addendum to this news release.

Rob and his team will work closely with Jo Price, VP Exploration of Ethos, to pursue a new strategy by Ethos to acquire and explore district scale gold projects in Canada. To initiate this strategy, based on the recommendations of the new advisory team, Ethos has recently staked two projects: the Schefferville Gold Project in Quebec and the Fuchsite Lake Gold Project in Ontario.

Commented Craig Roberts, P.Eng., President & CEO of Ethos: “we are very excited to be embarking on this new strategy to acquire district scale gold projects in Canada driven by an outstanding technical team. This team brings a long affiliation with Discovery Group and we look forward to working closely with Discovery Group in pursuing this new strategy. We are currently reviewing several other project opportunities and will announce any additional acquisitions as they occur.”

Schefferville Gold Project, Quebec

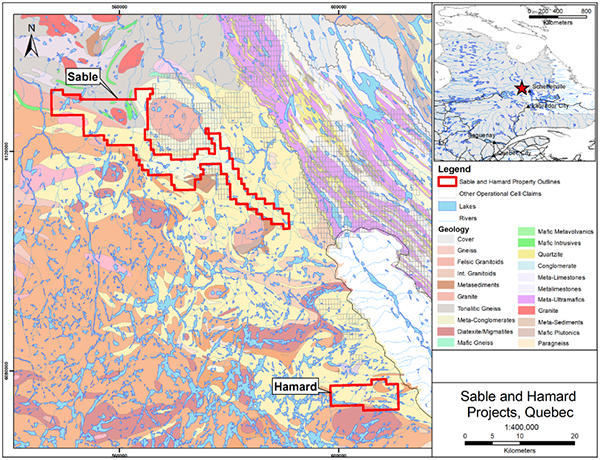

In Quebec, Ethos has staked a total of 288 km2 area in two claim blocks: the Sable block (234 km2) is centered 80 kilometers northwest of Schefferville and the Hamard block (54 km2) is centered 35 kilometers due west of Schefferville. The Sable and Hamard claims cover extensive areas of the Lilois Complex, a 2.7 billion-year-old unit characterized by the presence of numerous iron formations, many of which locally host gold mineralization. Sable and Hamard occur within a 20 km wide (east-west) by 70 km long (north-south) corridor along the Quebec - Labrador border. In 1985, a Quebec Ministry field team discovered the Lac du Canoe gold occurrence (up to 18.9 g/t Au). Between 1986 and 1997, follow up work by the Quebec Ministry and several companies resulted in the discovery of approximately forty (40) gold occurrences grading from 1 g/t Au to up to 40 g/t Au in mineralized iron formations with 3-20% pyrrhotite and up to 10% arsenopyrite. Subsequent drilling yielded intervals including 18.1 g/t Au over 0.7m, 5.83 g/t Au over 3.1m, and 1.05 g/t over 12.55m (Quebec Assessment Reports GM45903 & GM66613).

The primary exploration target is sulphidized iron formation, which occurs where the iron formations are cut by late, steep fault and shear structures that were pathways for hydrothermal fluids during deformation and metamorphism. This resulted in suphidization of the iron formations, with attendant gold and arsenopyrite mineralization, along and adjacent to these structures. Additionally, significant mineralization may extend into the bounding paragneisses, and also may be controlled by structures adjacent to contacts of paragneiss and iron formation with various intrusive bodies.

Planned work by Ethos on the Sable and Hamard claims aims to extend systematic gold exploration into geologically analogous but thinly till covered terrain, particularly along the major poorly exposed structures. A detailed aeromagnetic survey is planned for the claim blocks, to assist in defining the regional structural framework, but also (as confirmed possible by examining the results of some small-scale historic ground magnetic surveys) to directly define areas of magnetite-bearing iron formation within the paragneiss that tend to be expressed as subtle magnetic highs where unaltered, and are cut by discrete magnetic low trends where they are altered and sulphidized in areas favorable for gold mineralization. Marc L’Heureux, P.Geo., M.A.Sc. will act as adviser on the Schefferville Gold Project.

Fuchsite Lake Gold Project, Ontario

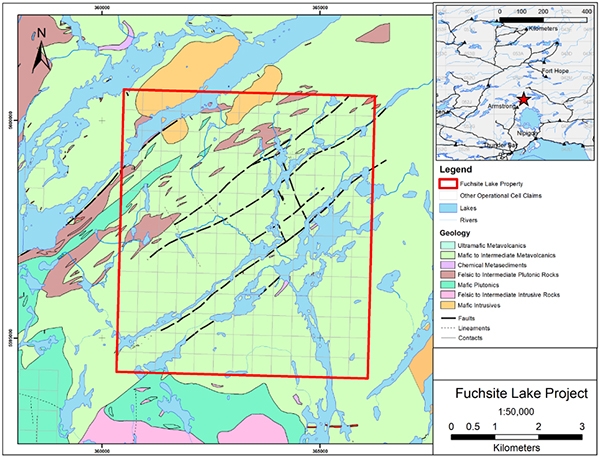

The newly staked Fuchsite Lake claim block comprises 3750 hectares located 20 km north of the town of Armstrong, Ontario. The southern boundary of the claim block can be accessed by forestry roads that link the property to the nearby town. The target is Archean shear zone hosted gold within deformed and altered ultramafic (fuchsite altered) and mafic volcanic rocks. This setting and rock type association is a major indicator of gold mineralization in many world class gold camps in the Superior Province of Ontario and Quebec.

The prospective shear zones each extend more than 5km along trend and were first identified by regional mapping programs in the 1970’s by the Ontario government (OGS Report 251). The region, however, has largely been overlooked by exploration companies. The only recorded work for gold comprises 5 short drill holes (all less than 40m deep) completed on the “Lett Occurrence” in 1981. Drill logs detail extensive hydrothermal alteration, brecciation, quartz veining and sulphide mineralization however no assays are available. The Ontario government sampled this outcropping zone (OGS Report 251) and obtained 1.7 grams per tonne gold and 1.4 grams per tonnes gold from two separate samples. No follow up work has been recorded in nearly 30 years.

The Fuchsite Lake claims represent a new greenfield fault zone gold target that has been overlooked and under explored despite reasonable access and favourable rock types and alteration that commonly accompany large gold discoveries. The presence of anomalous gold in outcrop samples within shears suggest a systematic structural and targeting program on the claim block will help assess the gold potential. Initial work will consist of ground truthing our shear zone model followed by an airborne magnetic survey designed to map out the structural geometry at the property scale.

The qualified person has not verified the drilling data disclosed in this release, including sampling data and assays. These data come from historical assessment and OGS reports made between 1981 and 1997.

Corporate Update

A technical team recently completed a site visit to the Company’s Perk Rocky copper-gold porphyry project. Exploration plans and budgets for this project are current being finalized and Ethos will provide an update on this project shortly. Plans and budgets for the Company’s Iron Point gold project in Nevada are also being finalized and an update on this project will be provided shortly. Ethos owns 1.9 million shares of Ridgeline Minerals which holds a portfolio of gold projects in Nevada. Ridgeline is currently completing an IPO priced at $0.45 per unit. As at mid-July Ethos has cash, receivables (primarily Quebec and BC tax and exploration credits) and securities (including the Ridgeline shares) of approximately Cdn $3.4 million.

Financing

Ethos announces the following private placements (collectively, the “Private Placements”):

- a private placement of 10,000,000 units priced at $0.14 per unit for gross proceeds of $1,400,000. Each unit will comprise one common share, and one half of one common share purchase warrant. Each whole such warrant will be exercisable into one common share of the Company at an exercise price of $0.20 for a period of two years following closing. The common share purchase warrants will be subject to acceleration at the Company’s discretion in the event its common shares trade on the TSX Venture Exchange on a volume weighted average price (“VWAP”) basis of C$0.40 or more for a period of ten consecutive trading days. Proceeds of this offering will be utilized on the Company’s Iron Point project in Nevada and for general working capital.

- an Ontario flow through private placement of 2,000,000 flow through units priced at $0.16 per unit for gross proceeds of $320,000. Each unit will comprise one flow through share, and one half of one non-flow through common share purchase warrant. Each whole such warrant will be exercisable into one common share of the Company at an exercise price of $0.22 for a period of two years following closing. The common share purchase warrants will be subject to acceleration at the Company’s discretion in the event its common shares trade on the TSX Venture Exchange on a volume weighted average price (“VWAP”) basis of C$0.40 or more for a period of ten consecutive trading days. Proceeds of this offering will be utilized on the Company’s Fuchsite Lake Gold Project in Ontario or on eligible flow through expenditures on other Ontario projects.

- a British Columbia charity flow through private placement of 3,000,000 flow through units priced at $0.18 per unit for gross proceeds of $540,000. Each unit will comprise one flow through share, and one half of one non-flow through common share purchase warrant. Each whole such warrant will be exercisable into one common share of the Company at an exercise price of $0.24 for a period of two years following closing. The common share purchase warrants will be subject to acceleration at the Company’s discretion in the event its common shares trade on the TSX Venture Exchange on a volume weighted average price (“VWAP”) basis of C$0.40 or more for a period of ten consecutive trading days. Proceeds of this offering will be utilized on the Company’s Perk Rocky copper-gold porphyry project in British Columbia or on eligible flow through expenditures on other British Columbia projects.

Members of the new technical advisory group are expected to participate in certain of the Private Placements. Finder’s fees may be paid on a portion of the Private Placements. The Private Placements are subject to the approval of the TSX Venture Exchange and customary closing conditions.

Qualified Person

The technical content disclosed in this press release was reviewed and approved by Jo Price, P.Geo., M.Sc., VP Exploration of Ethos and a Qualified Person as defined under National Instrument NI 43-101 (“NI 43-101”).

Contact

For additional information please contact Tom Martin at E: tmartin@ethosgold.com P: 1-250-516-2455 or view the Company’s website, www.ethosgold.com .and the Company’s sedar profile at www.sedar.com .

Ethos Gold Corp.

Per: "Craig Roberts"

Craig Roberts, P.Eng., President & CEO

Forward-Looking Statement Cautions:

This press release contains certain "forward-looking statements" within the meaning of Canadian securities legislation, including, but not limited to, statements regarding the Company’s plans with respect to the Company’s projects and the timing related thereto, the merits of the Company’s projects, the Company’s objectives, plans and strategies, the Private Placements, and other project opportunities. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are statements that are not historical facts; they are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "aims," "potential," "goal," "objective,", “strategy”, "prospective," and similar expressions, or that events or conditions "will," "would," "may," "can," "could" or "should" occur, or are those statements, which, by their nature, refer to future events. The Company cautions that Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made and they involve a number of risks and uncertainties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Except to the extent required by applicable securities laws and the policies of the TSX Venture Exchange, the Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change. Factors that could cause future results to differ materially from those anticipated in these forward-looking statements include the risk of accidents and other risks associated with mineral exploration operations, the risk that the Company will encounter unanticipated geological factors, or the possibility that the Company may not be able to secure permitting and other agency or governmental clearances, necessary to carry out the Company's exploration plans, risks and uncertainties related to the COVID-19 pandemic, risks and uncertainties related to the Company’s ability to complete the Private Placements and the size of the Private Placements, and the risk of political uncertainties and regulatory or legal changes in the jurisdictions where the Company carries on its business that might interfere with the Company's business and prospects. The reader is urged to refer to the Company's reports, publicly available through the Canadian Securities Administrators' System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com for a more complete discussion of such risk factors and their potential effects

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

ADDENDUM

Advisory Team

Rob Carpenter Ph.D., P.Geo., Chief Technical Advisor

Rob Carpenter is a Professional Geoscientist (P.Geo.) with more than 30 plus years of corporate and technical mineral exploration experience. He has founded and played key roles in several successful junior mining companies including Kaminak Gold Corporation. He led the Kaminak team as CEO from inception in 2005 through acquisition, discovery and maiden resource calculation of the multi- million ounce Coffee Gold Project, Yukon. Kaminak was acquired by Goldcorp in 2016 for over $500 million. In 2014, the Association of Mining and Exploration for British Columbia (AMEBC) awarded him and his team the Huestis Award for Excellence in Mineral Exploration for the discoveries at Coffee. AMEBC also awarded him the Robert Hedley Award for Social and Environmental Leadership in 2009 for his role in developing industry-Inuit partnerships in Uranium exploration. Rob completed his Ph.D. in 2004 at the University of Western Ontario focused on the setting and controls on the Meliadine Gold Camp in Nunavut. He is currently an Adjunct Professor at Western and is involved in helping a number of graduate thesis aimed at understanding gold deposits.

Robert A. Brozdowski, Ph.D., P. Geo.

Over 30 years diverse exploration experience emphasizing magmatic Ni-Cu-PGE & gold, but including uranium, VMS, SEDEX, and IOCG deposits. Worked with Callahan Mining Corp. from 1983-91 and subsequently with Western Mining Corporation (later WMC) across Canada & the USA from 1992-98. Consulting exploration geologist since 1998, involved in regional project generation, integrated regional field programs, and property-scale exploration projects for major, junior, and private clients in North & South America, Asia and Europe. Ph.D. Geology (Western University, London, ON, 1990), M.A. Geology (Temple University, Philadelphia, PA, 1983), and B.S. Geosciences (Pennsylvania State Univ., 1980).

Daniel MacNeil, M.Sc., P.Geo.

Economic Geologist specializing in Precious and Base Metals with over 19 years of experience from Continental scale project generation to in-mine resource expansion in a wide variety of geological settings in the Americas, Europe, Eastern Europe and the Near East. His expertise includes opportunity identification, business development, project evaluation, target and exploration strategy, district entry strategy, strategic evaluation of geologic terranes and execution of target testing. Mr. MacNeil has worked for numerous mining and exploration focused companies including Anglo American (3 years) and Barrick Gold Corp. (7 years) where he played a key role in the addition of 400K Oz gold and 30Moz silver to Eskay Creek Mine (Northwest British Columbia, Canada) and 20MOz gold to the Donlin Creek deposit (southwest Alaska, USA). Daniel MacNeil is the Founder of Vector Geological Solutions.

Dr. Alan J. Wainwright, Ph.D., P.Geo., FSEG

Dr. Wainwright is an economic geologist with 20+ years of mineral exploration and research experience in North America, South America, Europe and Asia, focused on base metals and gold. Alan has worked extensively on project generation, area selection, mapping, targeting, and drilling campaigns for porphyry Cu, epithermal/orogenic Au, magmatic Ni-Cu-PGE and SEDEX/skarn/CRD Zn-Pb-Ag, with several major mining companies and junior explorers. He was a co-recipient of the H.H. "Spud" Huestis Award (AME BC; 2013) for his role in the Coffee gold discovery in Yukon Territory (Kaminak Gold Corp; 5 Moz Au). He completed a PhD (MDRU-UBC; 2008) on the super-giant porphyry Cu-Au deposits at Oyu Tolgoi (Ivanhoe Mines; Mongolia), and led the Western Tethyan Metallogeny Project (Phase 2; 2016-2020) at MDRU, sponsored by 8 major/mid-tier mining companies. The Tethyan work focused on pre-competitive geoscience to support base metal and gold exploration in the Balkans, Turkey, and Caucasus. Dr. Wainwright is a Fellow of the Society of Economic Geologists (FSEG) and is registered as a Professional Geoscientist in British Columbia (PGeo; EGBC). Expertise includes copper/gold exploration, regional metallogeny, and volcanic arc geology.

Marc L’Heureux, P.Geo., M.A.Sc.

Marc is an experienced geologist with a tenure of more than 25 years in the industry. He has worked on gold, nickel, base metals, and diamond projects in North and Latin America. He served for many major companies such as Cambior, Falconbridge and Barrick. After 1997, he worked for junior corporations such as Boreal Exploration, GlobeStar Mining, Majescor Resources and Everton Resources. He is currently Vice-President Exploration for Vior Inc. Mr. L’Heureux holds a degree in Geology from the University of Quebec in Montreal (UQAM) and a Master Degree in Earth Sciences (Applied Geochemistry) from the University of Quebec in Chicoutimi. He is also a member in good standing of the Ordre des géologues du Québec (OGQ).

Jeff Sundar

Jeff Sundar has twenty years of experience in the capital markets and mineral exploration sector with a focus on corporate development, marketing, and financing. Jeff is Executive Director and formerly CEO of Genesis Metals Corp., a Discovery Group Company. Jeff was a Director of Northern Empire Resources (also a Discovery Group Company) which was acquired by Coeur Mining for $117 million for the Sterling Gold project in October 2018. He was also a Director and VP of Underworld Resources which discovered the 1.6 million oz White Gold deposit in west-central Yukon, and was subsequently acquired by Kinross Gold for $138 million in June 2010.