Investing in Metals: 2024 Market Trends

The metals investing landscape has been a profitable avenue for some savvy investors. Mining’s cyclical nature can reward those who are paying close attention with substantial returns. In this article, we will share the gold, copper, and rare earth elements outlooks for 2024 to help you make informed decisions when buying mining, royalties, and exploration stocks.

Gold

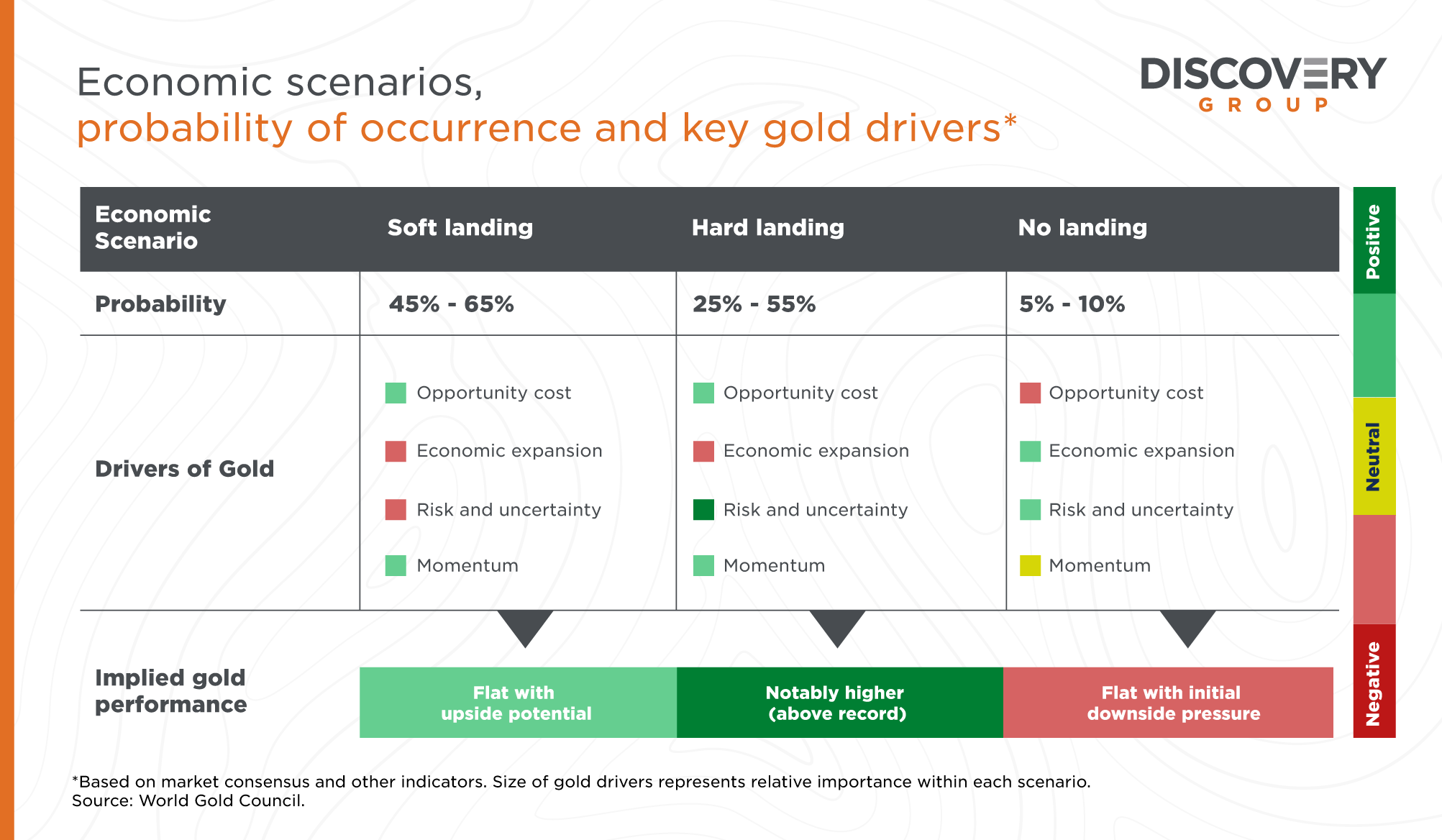

Gold had a strong 2023, surprising many by performing well despite a high interest rate environment, even outshining commodities, bonds, and most stock markets. Looking ahead to 2024, investors can anticipate one of three scenarios:

The market consensus suggests a ‘soft landing’ in the US – a gradual slowdown in economic growth - which is expected to have a positive impact on the global economy. However, geopolitical tensions during a key election year for many major economies, coupled with ongoing central bank purchases, may provide additional support for gold and a potential ‘hard landing’ scenario – a sharp slowdown in economic growth.

Furthermore, the probability of the Federal Reserve System successfully guiding the US economy to a safe landing with interest rates exceeding five percent remains uncertain. The possibility of a global recession still looms, encouraging many investors to hold effective hedges like gold stocks in their portfolios.

Copper

The dynamics of the copper market present a complex scenario with two opposing forces. On one hand, there's a strong and continuous demand for refined copper, particularly from China's solar energy sector. This demand is driving expansions in copper smelting capacity, which may result in an oversupply of refined copper in the market.

However, there's another important factor to consider. The demand for copper concentrate - the raw material used to produce refined copper - is expected to exceed the available supply, as copper miners struggle to keep up with Chinese demand. This will likely create a shortage of copper concentrate and lead to higher prices for the raw material. Factors such as the extended closure of First Quantum's Cobre Panama mine could impact this scenario even further.

This scenario is extremely positive for copper exploration companies, as new mineral deposits are urgently needed for miners to keep up with the growing demand for copper.

Rare Earth Elements

Analysts project a turnaround in rare earth prices for 2024 as demand surges from sectors like electric vehicles and wind power. Despite a significant downturn in 2023, the market's decline is expected to stabilize, particularly for elements like neodymium-praseodymium (NdPr) oxide, which are essential for permanent magnets used in various technologies. Projections indicate an 800-metric-ton global deficit of NdPr oxide for 2024 – flipping from last year's 6,600-ton surplus - indicating a potential shift in market dynamics as demand outpaces supply.

China's control over rare earth production is the key driver for this change, as experts predict a more modest increase in REE output quotas compared to previous years. While the country continues to dominate rare earth mining and refining, shifts in quota policies suggest a potential moderation in supply growth. China, which accounts for 70% of rare earths mining and 90% of refined output, has controlled its supply of the strategic resource through the quota system since 2006. This concentration in production makes investing in western REE exploration companies a compelling opportunity, as more mines are needed to decrease the looming geopolitical supply risks.

In summary, the 2024 metals investment outlook presents exciting opportunities. Gold remains a stable hedge amidst uncertainty, while increasing demand in sectors like renewable energy and technology offers growth potential in copper and rare earth elements. Additionally, investing in exploration stocks presents an enticing opportunity for investors seeking high-growth potential. By staying informed and diversifying their portfolios to include exploration stocks, investors can position themselves to reap the rewards of investing in metals in the years to come.